So, you’ve been using your credit card in Malaysia and loving the convenience it brings to your life. But lately, you’ve been finding that your spending needs are starting to exceed your credit limit. Don’t worry, you’re not alone. Many people face the same dilemma and wonder how they can increase their credit limit on a credit card. Well, fret no more! In this article, we’ll walk you through some simple and effective steps you can take to boost your credit limit and continue enjoying the freedom and flexibility of your credit card. So, let’s get started!

Evaluate Your Current Credit Limit and Usage

Understand your current credit limit

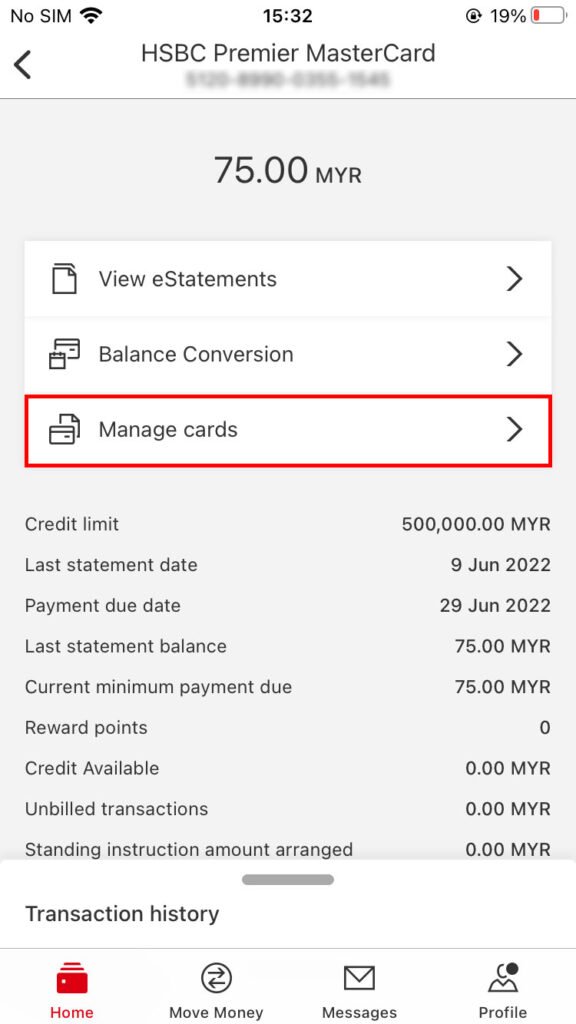

To increase your credit limit, you first need to have a clear understanding of your current limit. Check your credit card statement or log in to your online banking portal to find this information. Knowing your current credit limit will help you assess if it meets your needs or if you need an increase.

Review your credit card usage

Evaluate your credit card usage and determine if your current limit is sufficient for your needs. Are you frequently hitting your credit limit? Do you often find yourself needing to use multiple cards to make purchases? If so, it may be time to consider increasing your credit limit to better accommodate your spending habits.

Improve Your Credit Score

Pay your bills on time

One of the most important factors in increasing your credit limit is maintaining a good credit score. Paying your bills, including credit card bills, on time is crucial to demonstrating responsible credit behavior. Late payments can negatively impact your credit score, making it harder to secure a credit limit increase.

Decrease your credit utilization ratio

Your credit utilization ratio refers to the percentage of your available credit that you’re currently using. For example, if your credit limit is RM10,000 and your outstanding balance is RM5,000, your credit utilization ratio is 50%. To improve your credit score and increase your credit limit, aim to keep your credit utilization ratio below 30%.

Maintain a good credit history

Building a positive credit history over time can greatly improve your chances of getting a credit limit increase. Avoid any negative credit activities, such as defaulting on payments or applying for multiple credit cards within a short period. By consistently demonstrating responsible credit behavior, you’ll show your credit card issuer that you can handle a higher credit limit.

Contact Your Credit Card Issuer

Know the criteria for credit limit increase

Before reaching out to your credit card issuer, familiarize yourself with their criteria for increasing credit limits. The requirements may vary between issuers, so it’s important to be aware of any minimum income requirements, usage patterns, or credit history benchmarks they may have.

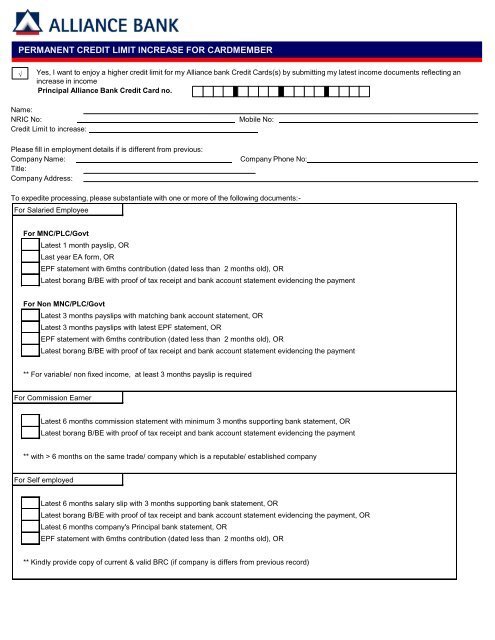

Prepare necessary documents

Gather all the necessary documents and information your credit card issuer may require to support your request for a credit limit increase. This may include recent bank statements, payslips, income tax returns, and any other proof of income or financial stability.

Request for a credit limit increase

Once you have all the necessary documents and information, reach out to your credit card issuer to request a credit limit increase. You can typically do this through their customer service hotline, online banking platform, or by visiting a branch in person. Clearly explain the reasons why you need the increase and provide any supporting evidence requested.

Show Proof of Income

Provide supporting documents

To strengthen your request for a credit limit increase, provide supporting documents that highlight your income stability. This can include recent payslips, employment contracts, or income tax returns. Demonstrating a steady and sufficient income will give your credit card issuer confidence in your ability to handle a higher credit limit.

Highlight your stable income

Emphasize any stability in your income, such as holding a long-term job or having multiple sources of income. The more stable and reliable your income, the more likely your credit card issuer will be willing to increase your credit limit. Showing proof of a consistent and sufficient income is crucial in demonstrating your ability to handle a higher credit limit responsibly.

Demonstrate Responsible Credit Behavior

Pay in full and on time

Consistently paying your credit card bills in full and on time is vital to maintaining a good credit profile. By doing so, you’ll show your credit card issuer that you can handle a higher credit limit responsibly. Late or missed payments can impact your credit score negatively and reduce your chances of getting a credit limit increase.

Avoid excessive credit utilization

Using a large portion of your available credit can signal financial instability to credit card issuers. Aim to keep your credit utilization ratio below 30%. By avoiding excessive credit utilization and keeping your balances low, you’ll demonstrate responsible credit behavior and increase your chances of a credit limit increase.

Maintain a low debt-to-income ratio

Your debt-to-income ratio reflects the percentage of your monthly income that goes towards debt payments. Ideally, you should aim to keep this ratio below 30%. A lower debt-to-income ratio indicates that you have enough income to cover your debts comfortably, which will give your credit card issuer confidence in approving a credit limit increase.

Utilize Credit Card Benefits

Utilize promotional offers

Credit card issuers often provide promotional offers such as cashback or discounts at selected merchants. Take advantage of these benefits by using your credit card for eligible purchases. Not only can this help you save money, but it also shows your credit card issuer that you actively use and benefit from having a higher credit limit.

Referral rewards or loyalty programs

Some credit card issuers offer referral rewards or loyalty programs that can earn you additional benefits or rewards. By referring friends or family to your credit card issuer, or by participating in loyalty programs, you may increase your chances of securing a credit limit increase as your credit card issuer sees the value you bring to their business.

Consider a Balance Transfer

Transfer outstanding balances

If you’re struggling with multiple credit card debts, consider transferring your outstanding balances to a credit card with a higher limit. This can help consolidate your debts and make them more manageable. However, be mindful of any balance transfer fees and interest rates associated with the new credit card.

Consolidate debts

In addition to using a balance transfer, consider consolidating your debts by obtaining a personal loan or a line of credit. This can help simplify your repayment process and potentially provide a higher credit limit, giving you more flexibility in managing your financial obligations.

Apply for a New Credit Card or Line of Credit

Consider applying for a new credit card

If increasing the credit limit on your current credit card is not an option, consider applying for a new credit card with a higher limit. Before doing so, assess your financial situation and research the available options to find a credit card that suits your needs and provides the desired credit limit.

Apply for a personal loan or line of credit

Another option to consider is applying for a personal loan or line of credit from a financial institution. These options typically offer higher credit limits than credit cards and can provide the funds you need while diversifying your credit mix. Be sure to compare interest rates and fees before deciding on the best option for you.

Monitor and Improve Your Credit Limit

Track your credit limit increase

Once you’ve successfully obtained a credit limit increase, it’s essential to monitor your credit limit regularly. Keep track of your new limit and ensure that it aligns with your needs. If necessary, consider adjusting your spending habits to avoid exceeding your new credit limit.

Review your credit reports regularly

Regularly reviewing your credit reports is crucial to identify any errors or discrepancies that may affect your credit limit increase. Request a free credit report from the credit reporting agencies in Malaysia and examine it carefully. If you notice any inaccuracies, contact the respective agency to rectify the issue promptly.

Work towards a Higher Credit Limit

Reassess your credit limit needs

As your financial situation evolves, periodically reassess your credit limit needs. Consider factors such as changes in income, spending habits, and future financial goals. By keeping your credit limit aligned with your needs, you can ensure that you have sufficient credit available while maintaining financial responsibility.

Maintain a good credit profile

Consistently demonstrating responsible credit behavior, such as paying bills on time and managing your debts effectively, is essential for maintaining a good credit profile. A positive credit profile not only increases your chances of getting a credit limit increase but also opens doors to better financial opportunities in the future.

Increasing your credit limit on a credit card in Malaysia requires diligent effort and responsible financial management. By understanding your current credit limit and usage, improving your credit score, contacting your credit card issuer, showing proof of income, demonstrating responsible credit behavior, utilizing credit card benefits, considering balance transfers or new credit applications, and monitoring and improving your credit limit over time, you can work towards securing a higher credit limit and enjoying the benefits it brings. Remember to maintain a good credit profile and regularly review your credit reports to stay on top of your creditworthiness.